Construction Accounting Software Built for Contractors

Foundation Software has all the back-office tools contractors need to run the business side of construction.

America’s #1 Construction Accounting Software

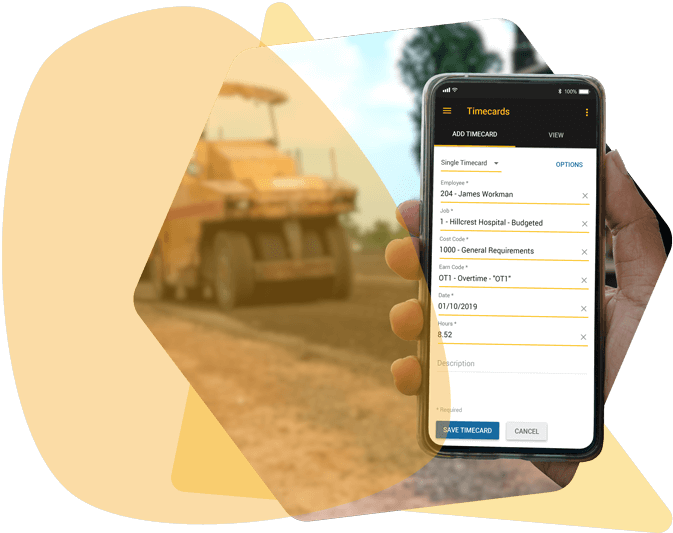

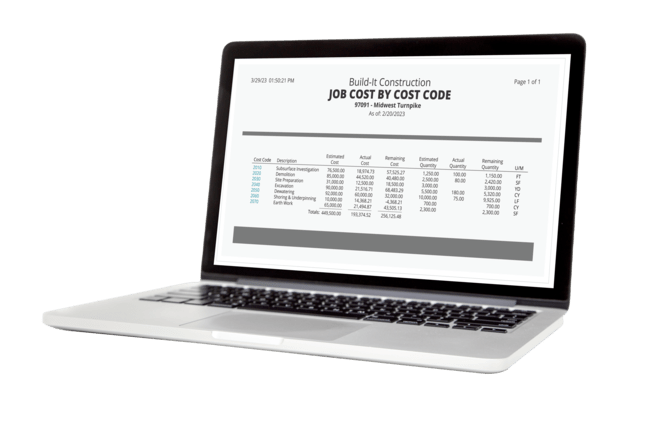

- Job Costing

Accurately Track the Details of Every Job with Customized Detail

- Track every dollar, hour and quantity for every job

- Instantly generate reports on project cash flows, work-in-progress and more

- Receive automated alerts to avoid overruns

Additional Foundation Software Products

Why Foundation Software?

Construction Experts.

With over 35 years of exclusively serving the construction industry, we’ve learned a thing or two — and we’re here to help you fix problems before they start.

Business Partners.

Other companies want your sale — we want your success. We help contractors run the business side of construction so they can stay focused on the project.

Ongoing Support.

Our best-in-class, in-house support team is here when you need. No robots. No outsourcing.

Trusted Nationwide.

Over 25,000 construction professionals across the entire United States trust Foundation to keep their companies running smoothly.

“The process was awesome. We had no problems, no flaws. We walked right through it, and it’s been running perfectly.”

Daniel T. Wilburn – Office Manager

Midwest Environmental, Inc.

Awards

We're not the only ones who think our products and company are noteworthy. Check out a list of the awards we've won over the years.

The Gartner Digital Markets badges from Capterra, GetApp, and SoftwareAdvice are trademarks and service marks of Gartner, Inc. and/or its affiliates are used herein with permission. All rights reserved. Gartner Digital Markets badges constitute the subjective opinions of individual end-user reviews, ratings, and data applied against a documented methodology; they neither represent the views of, nor constitute an endorsement by, Gartner, Inc. or its affiliates.

Our Events

Get access to the latest software announcements, product demos, connect with attendees from around the world, and more.

Educational resources to help build your skills and business.

Start building a better back office. Schedule a personal demo of our software to see how we can improve your business’s productivity.