Forecasting is critical for any well-run business, but it is even more so in construction, given the need to balance everything from crews and equipment, to bids, billings and job costs.

There is a growing trend among companies to base their decision-making on solid financial and project data, moving away from subjective factors such as gut feelings, personal opinions, and nonscientific assumptions. This shift highlights the importance of leveraging data-driven insights for making informed and accurate calls in business operations.

The shortcomings of what could be thought of as “rearview-mirror” perspectives are also becoming better understood. All too often, contractors get a sense of their performance by waiting until the end of the month, processing paperwork, building spreadsheets and then looking backward at a 10-day-old snapshot. Forecasts are often based, at least in part, on these backward glances. It’s a slow, manual process that tends to miss what’s happening now with projects and the company.

Streamlining revenue forecasting

Designed in concert with CPAs, CEOs, PMs and data scientists, newly emerging, automated financial workflows allow contractors to make better forecasts in areas such as revenue, final costs and cash flow. Access to live data in real time helps contractors put in place the right bonding capacity, personnel and other resources.

Let’s take a look at how this can work with revenue-forecasting:

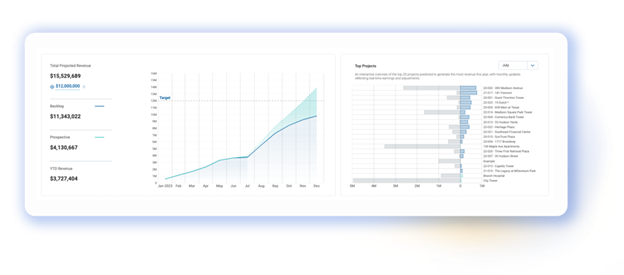

With a specially designed financial workflow, the contractor can enter data for jobs that it is bidding on while pulling out of the ERP all data for jobs under contract. The platform can then generate high-level summaries of progress toward previously inputted revenue targets.

The revenue forecast can be configured for the rest of the current year, or contractors can pull data to view projections into next year or later.

Start and end dates, total contract amounts, margin, and either a linear or S-curve distribution are among the fields/data visualizations in the forecast. Whenever the user adds a new prospective project, the tool automatically calculates the effects on the forecast and related KPIs.

A well-designed tool will update revenue projections based on changes to either the cost or the percent-complete side. Let’s say the PM had been counting on being 100 percent complete in October but needs to revise that down by 10 percent. With an automated tool, she can make that modification and see the effects in real time.

Benefits of automation

Because these tools pull right from the ERP, they provide insights into things like the prior revenue earned on a monthly basis, allowing the contractor to compare its actual-versus-projected performance and gauge whether its teams are on track.

These workflows also make it possible to drill into individual project details and see things like revised contract amount, percent complete, earned revenue, backlog revenue, job cost to date and projected final cost—all flowing directly from the ERP.

Generally, PMs who use such tools come to the table with a clearer understanding of how their actions directly affect project and company goals.

Costs and cash flow

In addition to revenue forecasting, specific automated financial workflows can be used for cash-flow projections and projected final costs as well.

A tool focused on the latter will allow PMs to run cost-to-complete analyses based on where their projects stand today.

Potential benefits include:

- Calculating the projected final cost for each cost code using methods such as percent complete, cost to complete, and quantity production rates.

- Accurately track cost-to-completion across multiple projects, all from the same unified dashboard

- Better understanding and capturing the root causes of project changes and trends

- Providing visibility into red flags and profit margin gain or fade, allowing for immediate intervention as needed

- Identifying trends across projects to pinpoint systemic issues and areas of improvement

Automated financial workflows designed specifically for projected final costs can give contractors more transparency into original and revised budgets, job costs and commitments, profit margins, and more. Granular breakdowns can unlock details of every project phase, cost code and cost class, providing more control.

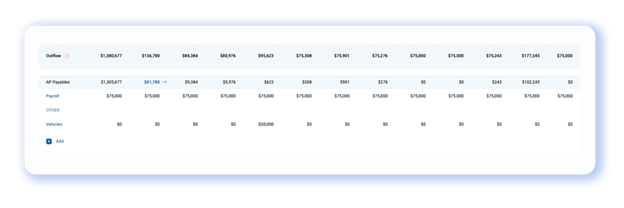

Along the same lines, contractors never want to act as “the bank” on their projects. Automated tools for cash-flow forecasting can help them avoid this problem. Fields in a good cash-flow forecast should include:

- Current trial balances

- Line of credit available

- Forecasted beginning balance

- Inflow (accounts receivable)

- Outflow (accounts payable)

- Net cash flow

- Forecasted ending balance

The result is a greater ability to track cash inflows and outflows and identify and address potential shortages.

Conclusion

Over the past couple of years, some of the country’s largest, construction-focused CPA and tax firms have started teaming with creators of financial workflows to introduce more contractors to these automated solutions. They recognize what these tools can offer for their clients: namely, a more efficient way to flag potential problems, make better predictions, and, ultimately, ramp up growth and productivity.

For more information on automated financial workflows, visit:

Share Article

Keep on current news in the construction industry. Subscribe to free eNews!

Our Top 3 YouTube Videos

Learn about our software more in depth with product overviews, demos, and much more!

Our ACA reporting & e-filing services include official 1094-C and 1095-C IRS reporting, optional e-filing (no applying for a TCC code required), mailing to your employees and experienced support to help you.

There are plenty of reasons to make FOUNDATION your choice for job cost accounting and construction management software — just ask our clients!

From job cost accounting software, to construction-specific payroll. Get an overview on your next all-in-one back-office solution.