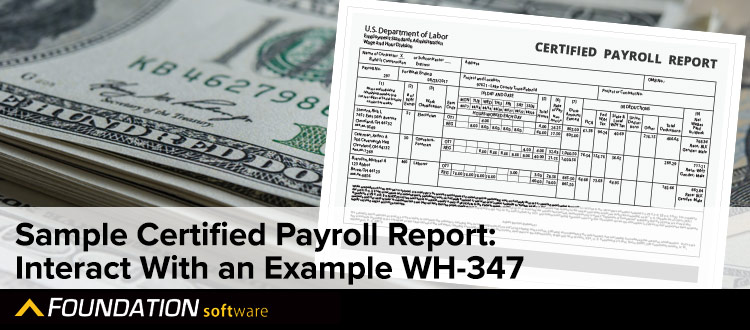

Certified Payroll Example: Interact With Form WH-347

5 Key Financial Ratios for Your Construction Business

The Future of the Percentage-of-Completion Method: The Impact of ASC 606

When to Capitalize vs. Expense Costs on a Construction Project

Five Facts on Davis-Bacon Wages Every Contractor Needs to Know

The Contractors Guide to New Revenue Recognition: ASC 606

The Definitive Construction Accounting Glossary

The Field Guide to Construction WIP Reports

3 Ways You Can Do Job Costing in QuickBooks Online

Make Your Inbox Smarter

Stay up to date with current news & events in the construction industry. Subscribe to free eNews!Our Top 3 YouTube Videos

Learn about our software more in depth with product overviews, demos, and much more!

Our ACA reporting & e-filing services include official 1094-C and 1095-C IRS reporting, optional e-filing (no applying for a TCC code required), mailing to your employees and experienced support to help you.

There are plenty of reasons to make FOUNDATION your choice for job cost accounting and construction management software — just ask our clients!

From job cost accounting software, to construction-specific payroll. Get an overview on your next all-in-one back-office solution.